What does homeowners insurance cover: Homeowners insurance policies generally cover destruction and damage to a residence’s interior and exterior, the loss or theft of possessions, and personal liability for harm to others.

Three basic levels of coverage exist: actual cash value, replacement cost, and extended replacement cost/value.

Policy rates are largely determined by the insurer’s risk that you’ll file a claim; they assess this risk based on past claim history associated with the home, the neighborhood, and the home’s condition.

In shopping for a policy, get quotes from at least five companies, and definitely check with any insurer you already work with—current clients often get better deals.

What does homeowners insurance cover / What a Homeowner’s Policy Provides

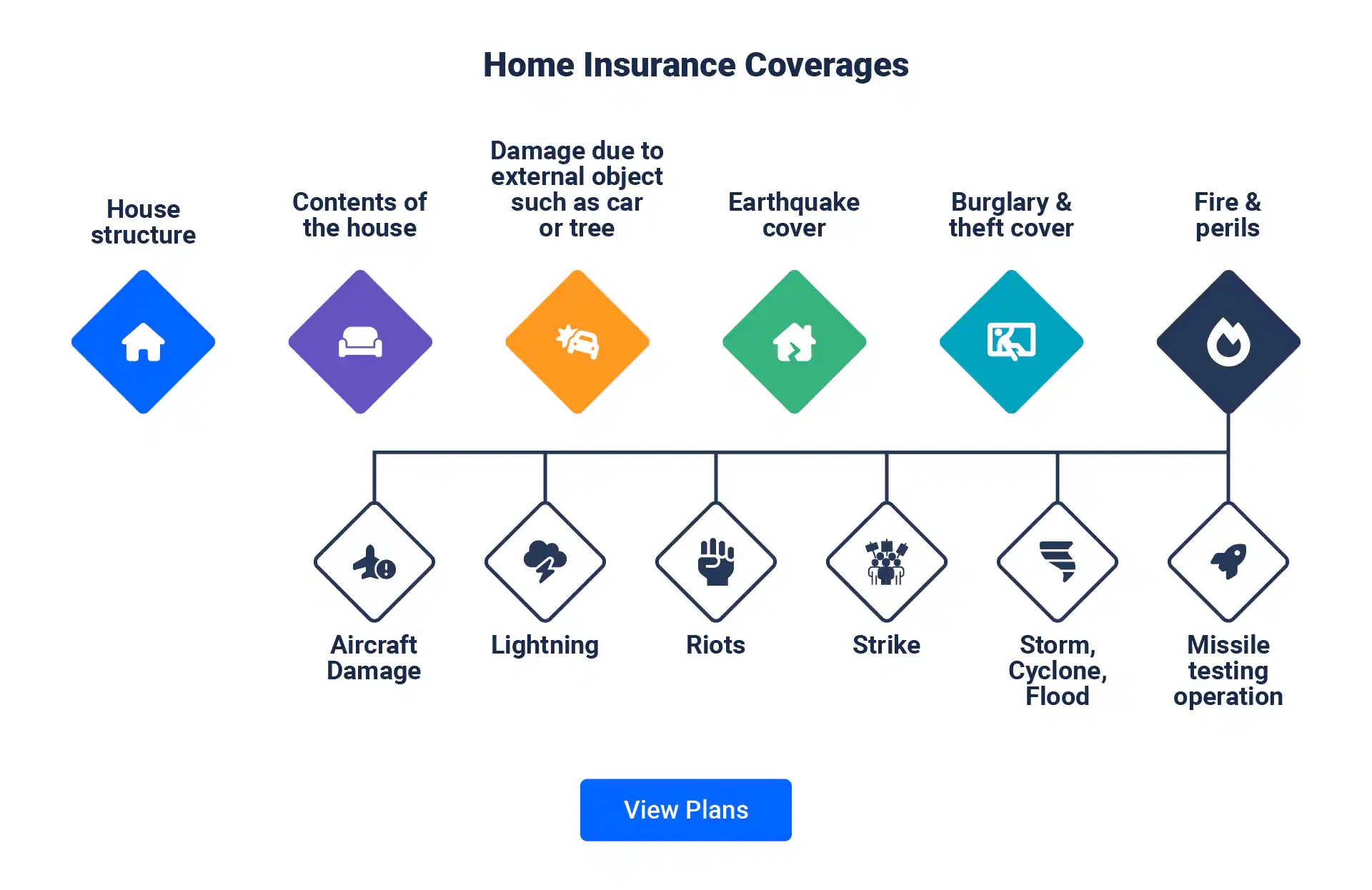

What does homeowners insurance cover: Although they are infinitely customizable, a homeowner’s insurance policy has certain standard elements that provide what costs the insurer will cover. Each of the main coverage areas are discussed below.

Damage to the Interior or Exterior of Your House

What does homeowners insurance cover: In the event of damage due to fire, hurricanes, lightning, vandalism or other covered disasters, your insurer will compensate you so your house can be repaired or even completely rebuilt.

Destruction or mutilation from floods, earthquakes, and poor home maintenance is generally not covered and you may require separate riders if you want that type of protection. Freestanding garages, sheds or other structures on the property may also need to be covered separately using the same guidelines as for the main house.

APOSTROPHE PROMO CODE NOVEMBER 2023

Clothing, furniture, appliances, and most of the other contents of your home are covered if they’re destroyed in an insured disaster. You can even get “off-premises” coverage, so you could file a claim for lost jewelry, say, no matter where in the world you lost it. There may be a limit on the amount your insurer will reimburse you, however.

According to the Insurance Information Institute, most insurance companies will provide coverage for 50% to 70% of the amount of insurance you have on the structure of your home.1 For example, if your house is insured for $200,000, there would be up to about $140,000 worth of coverage for your possessions.

WEBTOON PROMO CODES NOVEMBER 2023

If you own a lot of high-priced possessions (fine art or antiques, fine jewelry, designer clothes), you might want to pay extra to put them on an itemized schedule, purchase a rider to cover them, or even buy a separate policy.

Personal Liability for Damage or Injuries

What does homeowners insurance cover: Liability coverage protects you from lawsuits filed by others. This clause even includes your pets! So, if your dog bites your neighbor, Doris, no matter if the bite occurs at your place or hers, your insurer will pay her medical expenses.

Alternatively, if your kid breaks her Ming vase, you can file a claim to reimburse her. If Doris slips on the broken vase pieces and successfully sues for pain and suffering or lost wages, you’ll likely be covered for that, too, just as if someone had been injured on your property.

CYNCH PROMO CODE NOVEMBER 2023

While policies can offer as little as $100,000 of coverage, experts recommend having at least $300,000 worth of coverage, according to the Insurance Information Institute. For extra protection, a few hundred dollars more in premiums can buy you an extra $1 million or more through an umbrella policy.

Hotel or House Rental While Your Home Is Being Rebuilt or Repaired

What does homeowners insurance cover: It’s unlikely, but if you do find yourself forced out of your home for a time, it will undoubtedly be the best coverage you ever purchased.

This part of insurance coverage, known as additional living expenses, would reimburse you for the rent, hotel room, restaurant meals, and other incidental costs you incur while waiting for your home to become habitable again.

SHADOW FIGHT 3 PROMO CODES NOVEMBER 2023

Before you book a suite at the Ritz-Carlton and order caviar from room service, however, keep in mind that policies impose strict daily and total limits. Of course, you can expand those daily limits if you’re willing to pay more in coverage.

What Isn’t Covered by Homeowners Insurance?

What does homeowners insurance cover: Homeowners insurance policies typically include coverage for a wide range of perils and events that can cause damage to your property or belongings.

However, there are also several common exclusions, which are situations or events that are not covered by the standard policy. If you want coverage for many of these specific items, you’ll likely need to buy separate or private coverage.

There are several natural disaster occurrences are not covered by standard coverage. Standard homeowners insurance usually doesn’t cover damage caused by floods. Earthquake damage is typically excluded from standard homeowners insurance policies.

While some policies include limited coverage for sudden and accidental sinkhole damage, extensive or gradual sinkhole damage is often excluded as well.

BONCHON PROMO CODE NOVEMBER 2023

There are some home repair and maintenace type costs that are not covered. Many standard policies exclude damage from sewer or drain backups. Repairs or replacements due to the normal course of use are also generally not covered. Damage caused by termites, rodents, other pests, mold, and mildew may also be excluded, especially if prevention methods are not taken.

Last, there are many acts that do not constitute coverage. Damage caused by acts of war, terrorism, or civil unrest is usually not covered by standard homeowners insurance policies, nor is damage from nuclear accidents or radiation.

If you intentionally cause damage to your own property, it is unlikely to be covered by your insurance policy. In addition, if you need to rebuild or repair your home to comply with updated building codes or laws after a covered loss, the additional costs might not be fully covered by a standard policy.

What does homeowners insurance cover: Mold is generally not covered by homeowners insurance. Some companies cover mold damage with limitations, for example, if it’s caused by a covered event like a burst pipe. If mold damage is deemed to be the result of a lack of maintenance, it is generally not covered.

Does Homeowners Insurance Cover Roof Leaks?

Standard homeowners insurance policies usually cover roof leaks that are caused by a covered event, such as a storm or hail. In that case, the policy also will pay for repairs. If the cause of the leak is determined to be a lack of maintenance, the cost to repair damage may not be covered.

Does Homeowners Insurance Cover Water Damage?

What does homeowners insurance cover: Water damage from something like a burst pipe or failed washing machine hose is generally covered by a standard homeowners insurance policy, with the caveat that damage caused by a lack of maintenance is typically not covered.

FLIFF PROMO CODE NOVEMBER 2023

Flood insurance is not included in a standard policy, nor is a backup from a clogged drain or a failed sump pump. These coverages may be available at extra cost.

Does Homeowners Insurance Cover Termite Damage?

Damage caused by termites is generally considered preventable, and thus caused by the homeowner’s lack of attention and proper maintenance. In some circumstances such as a fire caused by a termite chewing through wiring, some insurers may provide coverage.

Does Homeowners Insurance Cover Theft?

What does homeowners insurance cover: Most standard homeowners insurance policies include coverage for losses from theft and vandalism, but all policies cap the amount the insurance company will pay.

Valuable items such as jewelry, artwork, or collectibles may exceed the limits of a standard policy, and require additional coverage.